Contents of the article

- Macroeconomic conditions: what influenced deposits in 2025

- How average deposit rates changed

- Maximum rates

- Foreign currency deposits: a tool for preservation, not income

- Key trends in the deposit market in 2025

- How the volume of household deposits changed

- Conclusions

In 2025, bank deposits remained one of the basic instruments for Ukrainians to preserve their savings. Despite military risks, inflationary pressure, and difficult macroeconomic conditions, the banking system remained stable, and the deposit market remained predictable and understandable for depositors.

To assess the extent to which deposits in 2025 fulfilled their key function — protecting funds from depreciation and generating predictable income — we will consider the factors that shaped the market, the dynamics of deposit rates, and changes in the volume of household savings.

Macroeconomic conditions: what influenced deposits in 2025

NBU discount rate

The key benchmark for the deposit market in 2025 remained the discount rate of the National Bank of Ukraine, which determines the cost of resources in the banking system and directly affects deposit rates.

After raising it from 14.5% to 15.5% in March, the NBU kept the discount rate at this level until the end of the year. This policy was aimed at maintaining the attractiveness of hryvnia savings, curbing inflation, and preserving financial stability.

For depositors, this meant relatively stable and predictable conditions: banks had no reason to sharply revise deposit rates, and hryvnia deposits remained competitive in terms of profitability.

Inflation rate

The inflation situation in 2025 improved overall compared to the previous year. While annual inflation was around 12% at the end of 2024, it fell to 8% in 2025.

At the beginning of the year, price growth remained high, but from the second quarter onwards, inflation began to decline steadily. This created a more favorable environment for hryvnia savings and increased the real effectiveness of deposits for the population.

Growth in household income

An additional factor supporting the deposit market in 2025 was the growth in household income. According to the State Statistics Service of Ukraine, the average salary during the year increased by approximately 26% and reached UAH 27,200.

The growth in income allowed households not only to adapt to inflationary conditions, but also to build up savings. This directly affected the inflow of funds into the banking system and supported demand for deposit products.

Conclusion for depositors

The combination of a stable discount rate, lower inflation in the second half of the year, and rising household incomes created a clear and predictable environment for the deposit market in 2025. In such conditions, hryvnia deposits retained their attractiveness and remained an effective tool for preserving and generating passive income.

How average deposit rates changed

In 2025, weighted average rates on hryvnia deposits increased, while foreign currency rates remained low with no significant changes.

Weighted average rates, % p.a.

| Currency | December 2024 | November 2025 | Dynamics |

| UAH | 12,3% | 12,7% | +0,4 в.п. |

| Foreign currency | 1,2% | 1,1% | –0,1 в.п. |

Data: National Bank of Ukraine website

For a more in-depth analysis, the UIRD index is used, which reflects the average interest rates in the 20 largest banks in terms of retail deposits. These banks account for over 90% of all household savings.

UIRD index dynamics in 2025

| Deposit term | 01.01.2025 | 31.12.2025 | Dynamics |

| 3 months | 13,27% | 13,41% | +0,14 в.п. |

| 6 months | 13,21% | 13,92% | +0,71 в.п. |

| 9 months | 12,83% | 14,04% | +1,21 в.п. |

| 12 months | 13,14% | 13,77% | +0,63 в.п. |

Data: National Bank of Ukraine website

2025 was a year of growth in average rates for all terms. The largest increase was observed for 9-month deposits, while the smallest increase was observed for 3-month deposits. This indicates a shift in the focus of banks towards medium- and long-term funding. Since the middle of the year, interest rates on annual deposits have again exceeded the yield on short-term deposits.

With an average rate of 13.77% p.a. for 12 months, net income after taxes was about 10.6%, which exceeded the annual inflation rate at the end of 2025 (8%). This means that even average market rates allowed depositors to maintain the purchasing power of their funds and generate real positive income.

Maximum rates

Maximum rates are traditionally set by banks with smaller deposit portfolios, which compete more actively for retail deposits. In 2025, such competition remained restrained: banks adhered to a balanced policy without aggressive promotions or sharp changes in rates, which contributed to overall market stability.

Dynamics of maximum rates in 2025

| Deposit term | 01.01.2025 | 31.12.2025 | Dynamics |

| 3 months | 16,50% | 17,50% | +1,00 в.п. |

| 6 months | 16,50% | 17,00% | +0,50 в.п. |

| 9 months | 16,50% | 16,90% | +0,40 в.п. |

| 12 months | 16,25% | 17,00% | +0,75 в.п. |

Data: Minfin.com.ua website

Unlike in 2024, in 2025, maximum rates did not decrease but gradually increased. Banks increasingly offered 16–17% p.a. in hryvnia, and in some periods, even higher yields, usually as part of promotional programs or for a limited segment of depositors.

If we look at the yield on deposits at Agroprosperis Bank during the year, a 12-month deposit in hryvnia at the beginning of the year could be placed at 15% p.a., and from March 2025 — already at 16.25% p.a.

This rate provided a net return of 12.51% p.a. after tax, which means about 4.5% real effective income, taking into account annual inflation in 2025. For the depositor, this was a deposit product that not only preserved funds but also provided a real positive financial result.

Foreign currency deposits: a tool for preservation, not income

Throughout 2025, interest rates on foreign currency deposits remained low:

- US dollar — 0.8–1.2% p.a.;

- euro — 0.5–1% p.a.

Even in banks that increased foreign currency rates, the changes were minimal and had no significant impact on the overall situation. Therefore, foreign currency deposits continued to serve primarily as a means of saving funds rather than generating income.

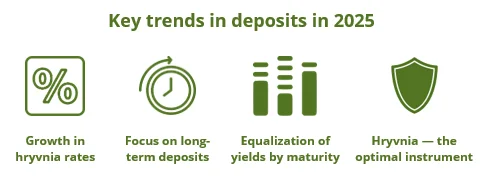

Key trends in the deposit market in 2025

Based on the results of the year, several consistent trends can be identified:

- average rates on hryvnia deposits increased by approximately 0.7 percentage points;

- banking institutions shifted their focus from short-term to medium- and long-term deposits.

- the difference between rates for different terms gradually narrowed.

- hryvnia deposits retained their status as the optimal instrument in terms of risk and return.

How the volume of household deposits changed

In 2025, Ukrainians continued to actively use bank deposits, maintaining their trust in the banking system. According to the NBU, as of December 1, 2025, the total volume of household deposits in banks reached UAH 1.55 trillion, which was a historic high for the Ukrainian banking system.

For comparison, at the end of 2024, the volume of household deposits amounted to UAH 1.347 trillion. Thus, in 2025, citizens' savings in banks grew by more than UAH 200 billion, which indicates a stable inflow of funds even in a war economy.

Hryvnia savings remained the main driver of this growth. They accounted for most of the increase in the deposit portfolio, while foreign currency deposits grew much more modestly. Ukrainians increasingly chose the hryvnia not only for storing funds in current accounts, but also for placing them in term deposits. The share of term hryvnia deposits remained close to one-third of all hryvnia funds held by the population.

Foreign currency savings, on the contrary, were mainly concentrated in current accounts. Term foreign currency deposits did not show any growth, reflecting the low profitability of such instruments and limited interest among depositors in long-term currency investments.

Overall, the dynamics of deposits in 2025 show that Ukrainians not only retained their trust in banks but also increased their savings, giving preference to more profitable and understandable hryvnia instruments.

Conclusions

In 2025, bank deposits remained a basic and effective savings tool for Ukrainians. Confidence in the banking system remained strong, and the market structure did not undergo any radical changes: the hryvnia remained the main instrument for generating income, while foreign currency deposits served primarily as a hedge.

The combination of a stable NBU discount rate, slowing inflation, and a gradual increase in deposit rates allowed hryvnia deposits to outpace inflation in 2025, even after taxation of interest income. This means that deposits remained not only a tool for preserving funds, but also a working financial solution for generating predictable income.

In the absence of a wide range of alternatives with a similar level of reliability and transparency, bank deposits continued to play a key role in the financial behavior of the population in 2025 — simple, understandable, and effective.

Read more useful information about deposits here: