Contents of the article

- What is a bank deposit and how to earn on it

- Deposit rates in Ukraine in 2025

- What taxes are paid on deposits?

- How does inflation affect income?

- How to calculate deposit profit

- How to increase profit from a deposit

- Checklist: how to earn more on deposits

- Frequently Asked Questions

- Conclusion

A deposit is one of the simplest and at the same time most reliable ways to make idle funds work in 2025. To earn more, it is important to take into account not only the interest rate, but also capitalization, loyalty programs, taxes, the impact of inflation, and other factors. In this article, we explain in simple terms and with real examples how to get the maximum income from a deposit.

What is a bank deposit and how to earn on it

A bank deposit is the placement of funds in a bank at interest. In fact, the bank uses your funds, and you receive income in the form of accrued interest. The peculiarity of term deposits is that you know the conditions in advance: the rate, the term, and the date when the deposit with accrued interest will be returned. Such transparency makes a deposit a convenient tool for financial planning.

The profitability of bank deposits is formed in accordance with the current NBU discount rate, the general macroeconomic situation, and largely the needs of each specific bank to attract funds.

Deposit rates in Ukraine in 2025

The bank sets the level of interest rates depending on the following factors:

- Deposit term. Banks offer higher rates for the terms for which they need to attract funds. Traditionally, the longer the term, the higher the rate, since the bank has the opportunity to use resources longer. However, in 2025, given the instability of the economic situation, shorter deposits of 3–6 months are more popular.

- Currency. Deposits in hryvnia provide the highest profitability. Foreign currency deposits have significantly lower rates, sometimes almost zero, but provide additional protection against exchange rate fluctuations.

- Capitalization of interest. The use of compound interest for long-term deposits makes it possible to increase profitability and raise the result for the depositor. For such deposits, the rate will be lower than for deposits with ordinary accrual of interest, but the real profitability will be higher.

Let us consider what deposit rates offer Ukrainian banks in September 2025. For this, we take two indicators — the average indicative rates on deposits in the twenty largest banks of Ukraine, which account for more than 90% of all household deposits (UIRD index), and the maximum rates that can be found on the market.

Average deposit rates as of 19.09.2025, % p.a.

| Deposit term | UAH | USD | EUR |

| 3 months | 13.56% | 0.85% | 0.29% |

| 6 months | 14.15% | 1.03% | 0.37% |

| 9 months | 14.16% | 1.18% | 0.41% |

| 12 months | 13.83% | 1.29% | 0.47% |

Source: National Bank of Ukraine website

Highest deposit rates as of 19.09.2025, % p.a.

| Deposit term | UAH | USD | EUR |

| 3 months | 17.17% | 2.50% | 2.25% |

| 6 months | 17.25% | 2.50% | 1.70% |

| 9 months | 17.50% | 2.70% | 1.75% |

| 12 months | 17.25% | 3% | 2% |

Source: Minfin portal

The maximum rates in hryvnia exceed the average figures by more than 3 percentage points, so it is important to monitor current interest rates on aggregator websites, where offers from most Ukrainian institutions are collected.

Deposits in Agroprosperis Bank

What taxes are paid on deposits?

From the income on a deposit, the depositor is obliged to pay personal income tax (PIT) at the rate of 18% and a military levy at the rate of 5%, which in total amounts to 23%. The bank independently withholds and transfers taxes on deposit income in Ukraine, so the depositor receives already net profit after all mandatory deductions.

To quickly estimate the net income after taxation of a deposit, simply multiply the amount of accrued interest by 0.77 (100% – 23% of taxes and levies). That is, for every 100 hryvnias of accrued interest, you will receive 77 hryvnias “in hand.”

How does inflation affect income?

If your money just lies in an account or at home “under the mattress,” it loses its purchasing power every day due to inflation. For example, in 2024 inflation was 12%, so the purchasing power of your UAH 100,000 decreased to the equivalent of UAH 88,000.

A deposit is the simplest way to protect savings from depreciation. With inflation of 10% and a real rate of 12%, the real growth will be ≈2% p.a. If inflation equals or exceeds the rate, it works as a tool to reduce the impact of inflation but does not provide real growth.

How to calculate deposit profit

Formula for calculating profit

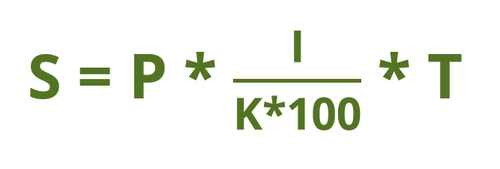

Accrued income is determined by the formula:

where: S — amount of accrued interest, P — deposit amount, I — annual interest rate, T — number of days of the deposit, K — number of days in the year

Example of calculation

Let us calculate the profit for the deposit Classic+ for UAH 100,000 for a period of 12 months, for which as of 19.09.2025 the rate is 16.25% p.a. in hryvnia.

- Determining income before taxation

Substitute the parameters of the selected deposit into the formula:

S = 100,000 × (16.25 / (365 × 100)) × 365 = UAH 16,250 – this is the total amount of accrued interest on the deposit before taxes.

- Determining income after taxation

Next, we deduct 23% of taxes and levies that the bank pays on behalf of the depositor. To find out the amount of profit after paying taxes, multiply the income by 0.77: 16,250 × 0.77 = UAH 12,512.5 – this is the amount of profit after taxation.

Thus, your deposit of UAH 100,000 per year will bring net income of UAH 12,512.5, which corresponds to an effective rate of 12.51% p.a. after taxation.

- Determining the impact of inflation

At the same time, it is worth considering the level of inflation, since it determines the real profitability of the deposit. According to the results of 2025, inflation is projected at 9.7%, so the real rate, taking into account the inflation, will be about 2.81%. As we can see, the Classic+ deposit will not only fully protect money from depreciation but also provide real profit.

Formula for calculation with capitalization

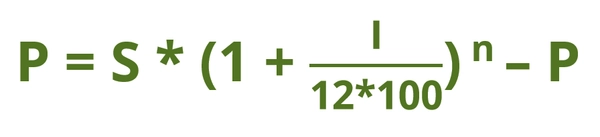

With monthly capitalization, the amount of accrued income is determined by the formula:

where: P — accrued income, S — initial deposit amount, I — annual interest rate, n — number of months of capitalization

Example of calculation

Let us calculate the profit for the deposit Capital for UAH 100,000 for a period of 12 months, for which as of 19.09.2025 the rate is 15.50% p.a. in hryvnia.

- Income before taxation: S = 100,000 * (1 + 15.5 / (12*100))^12 – 100,000 = UAH 16,650.

- Income after taxation: 16,650 × 0.77 = UAH 12,820, and the rate after taxation is 12.82%.

- Real rate: 12.82% – 9.7% = 3.12% net growth considering the impact of inflation.

As we can see, despite the lower nominal rate, a deposit with interest capitalization brings higher net income due to the effect of compound interest. The longer the deposit term, the more noticeable the effect.

Deposit calculator

A convenient way to determine your future income is to use a deposit calculator. Such a tool is necessarily available on the website of any bank for each deposit program and is also presented on numerous financial resources. You can find detailed explanations and calculation examples in our article How to calculate the profit from the deposit.

How to increase profit from a deposit

A deposit can become a reliable source of income if you choose it correctly. To select the most profitable deposits, it is worth considering several key rules.

Choose a bank separately for a card and for a deposit

Many people place money on deposit in the bank where they receive income on a card or which they use for daily transactions. However, this is not always profitable. Large banks often offer lower rates than smaller ones, as confirmed by the comparison of average rates in the largest banks and maximum rates on the market. Therefore:

- one bank may be convenient for daily payments and banking,

- another — more profitable for placing deposits.

Look not at the rate, but at the yield

The highest rate does not always mean the highest earnings. What matters is how interest is accrued and paid:

- if interest is capitalized (added to the deposit amount), then even at a lower rate you may end up with a higher income;

- if interest is paid monthly to a card, the final yield may be lower.

We have already seen in the calculations above that the deposit Classic+ of UAH 100,000 for 12 months at 16.25% with payment at the end of the term will bring UAH 12,512.5 net in hand. However, the same UAH 100,000 placed in the Capital deposit for 12 months at 15.5% with capitalization will give UAH 12,820, although the nominal rate is lower. At the same time, the Capital deposit can be supplemented with additional contributions, which will allow you to accumulate the maximum amount.

Conclusion: always calculate the “net income in hand” using a deposit calculator.

Choose deposits with top-up option

If a deposit allows you to add funds, you will be able to gradually increase the amount on which interest is accrued. This way you can both save more money and receive more interest:

- If you add, for example, UAH 5,000 monthly, then after a year the deposit amount will be significantly larger than the initial one.

- If market rates fall, you will be in an even better position, since both the entire deposit and each new top-up will work at the old, higher rate.

Use bonuses from banks

Banks often encourage depositors with additional bonuses. This can be +0.25–1% to the rate for fulfilling certain conditions, such as:

- large deposit amounts;

- online application;

- automatic renewal of the deposit;

- special conditions for privileged categories;

- special conditions for premium clients.

For example, in Agroprosperis Bank favorable conditions apply to deposits for pensioners, which provide an additional +0.25% to the deposits Classic+ and Classic regardless of the term and amount of the deposit.

Follow promotions

Banks often conduct short-term promotions during which money can be placed at a higher rate. Or they raise rates for certain terms that are a priority for them at the current time. Such offers may last only one to two months but allow you to earn more.

Receive deposit income to a card with interest on balance

Clarify whether it is possible to receive interest from a deposit directly to a card on which interest is accrued on the balance of funds. This way you will get double the benefit:

- the main income from the deposit,

- additional income from the balance on the card.

The amount is small, but pleasant. For example, if UAH 1,000 of interest is credited monthly to a card and you do not withdraw it, then in a year you can additionally earn more than UAH 700. By the way, free funds for daily expenses are also conveniently stored on this card, since you have full access to the money and at the same time earn on it.

In Agroprosperis Bank you can receive income from a deposit on the Mriya+ card, which accrues from 5% to 8% p.a. on daily balances, and top-ups, cashless payments and cash withdrawals at all ATMs in Ukraine are free of charge.

Diversify savings

It is not worth concentrating all funds in one deposit. Distribute them according to two criteria:

- Currency: part in hryvnia (higher profitability), part in foreign currency (protection against devaluation).

- Terms: part for a longer term in a reliable bank, part for short terms of 3–6 months at the maximum rate.

Example of diversification:

- Long deposit with top-up and capitalization

Such term deposit allows you to fix the rate for a long term and earn income on a larger amount thanks to monthly top-ups and capitalization of interest. This is suitable for strategic savings — for example, for a large purchase or accumulation for the future. For example, the deposit program Capital provides for monthly capitalization of interest and the possibility of replenishing the deposit with additional contributions. - Short deposit for 3–6 months at the maximum rate

A short-term deposit makes it possible to regularly review the market and place money where at the moment the highest rate is. It allows you to get money faster if necessary or in unforeseen circumstances, as well as transfer it to another deposit with a more favorable rate. - Deposit in foreign currency to insure against devaluation risks and create a financial cushion.

- Card with interest on balance for keeping free funds with full access to them at any time.

The combination of different deposits allows you to:

- fix part of the income for a long term in a reliable bank and make the most of the capitalization effect;

- quickly respond to changes in market rates and obtain maximum profit;

- protect yourself against exchange rate changes;

- maintain flexibility and liquidity to have funds at hand.

Take into account rate change trends

- If a decrease in deposit rates is expected — it is more profitable to fix money for a longer term at the current high rate.

- If an increase in rates is expected — on the contrary, it is better to place funds for short terms, so that later they can be reapplied at a higher rate.

Checklist: how to earn more on deposits

So, let us briefly summarize the main tricks that will help you earn more on deposits:

- Choose a bank for a deposit separately from the bank for daily transactions.

- Compare net income, not just the interest rate.

- Choose deposits with top-up option.

- Check banks’ bonus programs.

- Follow short-term promotions.

- Receive income on a card with interest on balance.

- Diversify savings by currencies and terms.

- Focus on market trends: whether rates are rising or falling.

Frequently Asked Questions

What is the difference between the nominal rate and the effective rate?

The nominal rate on a deposit is the annual percentage that the bank accrues on the deposited amount. It is indicated in advertising, in the bank deposit agreement and is the basis for calculating the depositor’s income. The effective rate is the rate after payment of mandatory taxes and fees.

How often does the National Bank change the key policy rate?

Decisions on the key policy rate are made eight times a year at regular meetings of the NBU Board on monetary policy. In addition, extraordinary meetings may be convened if necessary.

Why rates in foreign currency are significantly lower than in hryvnia?

Banks are less interested in attracting resources in foreign currency than in national currency, which is related to the current monetary policy of the NBU and the low demand of the population and businesses for foreign currency loans.

Can a bank review the rate on an existing term deposit?

No, the rate is fixed when opening the deposit and is valid until the end of its term. The bank has no right to change it.

Is it possible to withdraw a deposit early?

Most term deposits do not provide for early withdrawal and termination of the agreement. If a deposit has such a possibility, then its yield is lower, and termination takes place with the loss of part of the accrued interest. In Agroprosperis Bank the possibility of early termination is available for the Savings deposit.

Conclusion

A deposit in 2025 remains one of the most reliable and simplest ways to preserve and increase funds. The correct choice of term, currency and placement conditions allows you to obtain stable income, protect savings from inflation and ensure financial predictability. And placing funds in Agroprosperis Bank means choosing a financial partner that combines reliability, stability and favorable conditions.