Article content

- Criteria for choosing which bank to open a deposit

- What to pay attention to when choosing a reliable bank

- NBU license

- Participation in the Deposit Guarantee Fund

- Actual owners

- Credit rating

- Compliance with legislation

- Implementation of ratios

- Reputation on the Internet

- Customer reviews

- Personal impression

- Reliability ratings of banks

- A deposit at Agroprosperis Bank is reliable and profitable

- Conclusion

A deposit in a bank is the most understandable and simplest way of obtaining additional income. If we want to get the most out of our own savings, we look for the most profitable offers and first of all, choose the deposit. The bank, its reputation and stability are usually of much less interest to us. However, looking for an answer to the question - in which bank is it better to put a deposit in the 2026 year, we are paying attention not only to the deposit rates, but also more carefully evaluating the financial institution, because in the conditions of a full-scale war is important to be sure that your savings are safe.

Criteria for choosing which bank to open a deposit

To determine which bank is best for opening a deposit account, consider the following key criteria:

1. Deposit yield

Compare deposit rates at different banks. The highest interest rates do not always mean the best return — sometimes they come with risk. The optimal situation is when the rate is slightly higher than the market average and the bank has a stable reputation.

2. Bank reliability

The security of funds is paramount. Choose institutions that have a transparent ownership structure, stable financial indicators, and a positive reputation among customers.

3. Convenience and digital capabilities

A modern bank should provide the ability to open, replenish, and control deposits online, without the need to visit a branch.

4. No fees

Check whether the bank charges additional fees for opening or closing a deposit, as well as for crediting interest to a card, withdrawing income paid at ATMs, or transferring funds using bank details.

The optimal solution for those who seek to combine high profitability and reliability is small banks with foreign capital. They offer more attractive conditions while competing for clients and maintaining high safety standards thanks to their international founders. One of them is Agroprosperis Bank.

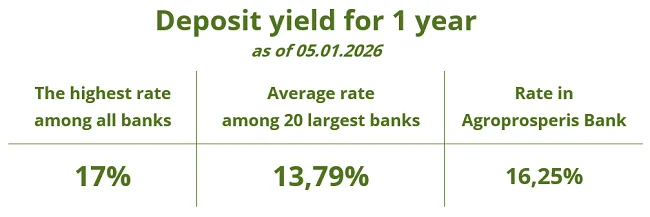

The chart below shows a comparison of deposit returns at Agroprosperis Bank, the maximum returns on the market, and the UIRD index. The UIRD index reflects the average deposit rates among the top twenty banks with the largest deposit portfolios for individuals. Among them are the largest state-owned and foreign banks, which are considered the most reliable.

As we can see, thanks to their scale and huge customer base, the top twenty banks can afford to set lower rates. It significantly affects the final yield for depositors and force them to look for better options... In the next section, we will consider the reliability criteria by which you can determine which bank is the best place to deposit money.

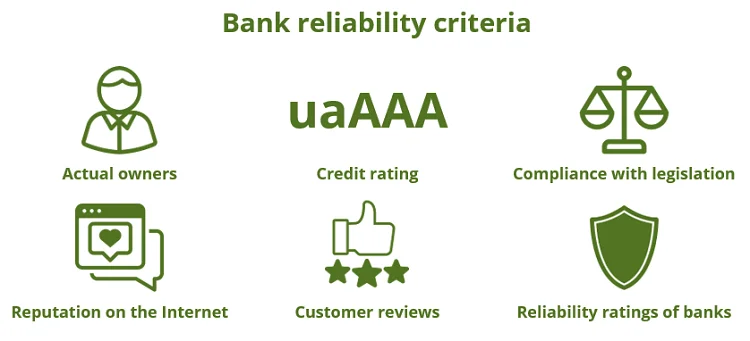

What to pay attention to when choosing a reliable bank

Unfortunately, there is no single indicator that would guarantee the reliability of a bank, and in order to make the right decision, you need to comprehensively consider all available information. For a customer deciding which bank is best to deposit money in, in practice, it is enough to check a few basic things that determine the real reliability of a bank. So, to determine which bank is the best to open a deposit, analyze the bank in which you are most interested in making a deposit according to the following indicators:

NBU license

First off, banks can only operate after getting a license from the National Bank of Ukraine. You can check out info on your bank on the NBU website under Bank Search.

Participation in the Deposit Guarantee Fund

Every Ukrainian bank, without exception, is part of the DGF. This means that your funds in banks are guaranteed by the state: during martial law and for three months after its end, full reimbursement of deposits with interest is guaranteed, regardless of the amount. After the end of martial law, a limit of up to UAH 600,000 per depositor in one bank will apply.

Actual owners

When determining which bank is the best place to deposit money, the first thing you need to know is who are the ultimate beneficiaries, that is, the owners of the chosen bank. Banks are obliged to disclose this information on their own website, and this data must also be posted on the website of the National Bank in the section Ownership structures of banks. Ffind information about activities and reputation of the bank's owners and draw conclusions for yourself whether you are ready to trust them with your savings.

Credit rating

For most depositors, ratings are a convenient and visual way to quickly understand which bank is better to open a deposit in without delving into financial statements. Credit rating is assigned to banks by specialized rating agencies and is an indication of the bank's creditworthiness and reliability. At the same time, rating agencies analyze the bank's financial statements, regulations and performance indicators, on the basis of which they draw conclusions about the level of its solvency and sustainability. If you are choosing which bank to put a deposit in, then credit rating and rating reports of agencies are one of the most truthful assessments of the bank's stability by specialists. Banks usually post information about the credit rating on their website, and the rating agency must also publish data on assigning, updating and changing the credit rating.

Compliance with legislation

The National Bank publishes on its website information on fines imposed on banks for non-compliance with legal requirements. These can be violations of payment discipline, violations in the field of anti-money laundering, unethical behavior when working with debtors, etc. Agree, a deposit in a bank that repeatedly violates the law is not the best choice.

Implementation of ratios

There are a number of mandatory economic ratios established by the National Bank that regulate the activities of banking institutions. They show capital adequacy, liquidity and asset quality. Compliance with regulations in itself is not an absolute guarantee of stability, however, systematic and long-term compliance with regulatory requirements is an important indicator of an institution's financial discipline for clients who are choosing which bank is best to open a deposit with. Information on the main indicators of banks' activity and the level of standards is available on the NBU website in the Supervisory Statistics section.

Reputation on the Internet

Visit the official website of the institutions, view its pages in social networks and on the main sites about banks, get acquainted with publications in the mass media. If a bank is actively developing, publishes reports, and participates in professional ratings, it means that the bank is working and developing.

Customer reviews

When choosing which bank is better to deposit money in, you should find out what its customers say about the bank. Especially if you still didn't know much about the bank in which you want to place a deposit. To do this, look at reviews about the financial institution on Google maps, on social networks and on the most popular financial websites. Of course, all of us are more inclined to write negative reviews and take quality service as a given, so the real assessment of the bank and the level of its services will be a little higher.

Personal impression

If in doubt, visit the branch. Personal communication with the employees will help you assess the level of service and trust.

Reliability ratings of banks

It seems that in order to decide in which bank it is best to open a deposit, you need to become a little bit of a banker yourself, because it is not so easy to understand all the peculiarities of banks' work and indicators of their stability.

In such a difficult matter, it is easier and more effective to trust market professionals who publish their analysis of the stability of Ukrainian banks and the reliability of bank deposits every quarter. Some ratings consider only systemically important banks and do not include information on smaller players. Among the ratings that consider the largest number of banks, the following can be distinguished:

- Financial scoring of Ukrainian banks by YouControl, which analyzes the first 40 banks by assets. Financial reliability indices are calculated on the basis of 25 indicators that reflect liquidity, capital adequacy, profitability, credit, currency and investment risks.

- Rating of stability of banks from the financial portal of the Ministry of Finance, which includes banks with a portfolio of individual deposits of UAH 1 billion, which as of the 4st quarter of 2024 is 34 banking institutions. The rating includes the calculation of such indicators as the bank's stress resistance, the loyalty of depositors and the assessment reliability by a group of experts.

A deposit at Agroprosperis Bank is reliable and profitable

At Agroprosperis Bank, depositors receive a high return on deposits combined with their high reliability. Agroprosperis Bank is a bank with foreign capital of the USA and Europe, whose investor NCH Capital has been managing long-term investments in the amount of more than 3 billion dollars for 30 years. USA in 10 countries around the world. An important factor in the bank's stability is its specialization in agricultural lending – one of the most stable and significant sectors of Ukraine's economy.

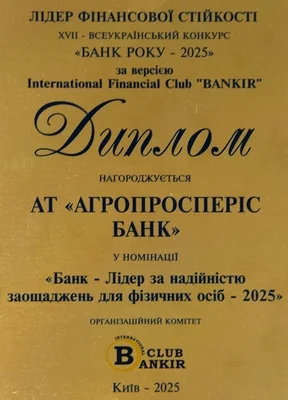

In August 2025, Agroprosperis Bank's credit rating was upgraded to uaAAA, which characterizes the highest creditworthiness. In addition, the bank regularly confirms the highest deposit reliability rating of ua1, assigned by RA “Expert-Rating.”

At the end of the first nine months of 2025, its assets grew by UAH 522 million to UAH 5.313 billion, and its agribusiness loan portfolio increased by 1.5 times to UAH 1.52 billion. These results demonstrate the stable growth and effective performance of the institution.

In 2024, Agroprosperis Bank won the “Best Deposit” nomination of the prestigious FinAwards 2024 award from the Minfin and Finance.ua portals, and in 2022-2025, it took first place in the Bank of the Year competition from the International Financial Club Bankir competition in the categories “Leading Bank for Reliability of Savings for Individuals” and “Best Bank for Agribusiness,” making it the optimal solution for customers who are deciding which bank is best to deposit their money in 2026.

In addition, the bank was recognized as the best in the Banker Awards 2024 in the category “Leader in Agricultural Banking” and the winner in the nomination “Niche Bank” in the rating of AUB members on the occasion of the association's 10th anniversary.

Advantages of deposits at Agroprosperis Bank:

- attractive deposit rates and service fees;

- ability to manage your deposit online without visiting a branch;

- no fees for opening, closing, or paying interest;

- stability of the bank with foreign capital from the US and Europe;

- participation in the Deposit Guarantee Fund for individuals;

- specialization in lending to agriculture, one of the most stable sectors of the Ukrainian economy;

- the highest investment credit rating of uaAAA and the highest deposit reliability rating of ua1 from the Expert-Rating agency.

Conclusion

When choosing which bank to open a deposit account with, pay attention not only to the interest rate, but also to stability, reputation, transparency, and ease of managing your deposit.

And if you are looking for the optimal combination of profitability and reliability, consider Agroprosperis Bank — a bank with foreign capital that provides high returns, security of funds, and a modern level of service.

Read more about whether it is profitable to place a deposit now and how to choose a deposit program in our articles:

- How to choose a deposit

- Is it profitable to open a deposit in 2025

- In which currency is it better to open a deposit

- About the system of guaranteeing deposits of individuals