Article content

- What is a deposit and how does it work

- What are the types of deposits?

- Is it safe to place a deposit?

- How are deposits of individuals taxed?

- What are the advantages and disadvantages of deposits?

- What determines the yield of a deposit?

- What are the deposit rates offered by banks?

- Deposit bonus

- Top 5 reasons to place a deposit

A deposit is money that you place in a deposit account at a bank for a fixed term or indefinitely, and the bank pays you interest on it. This is the simplest and most common way to save money and earn a guaranteed income. In this article, we will briefly and clearly explain what a bank deposit is, how it works, what conditions affect the profitability of a deposit, and why this instrument is considered one of the safest for saving money.

What is a deposit and how does it work

To confidently place a deposit, it is important to understand what happens to your money after you open a deposit. We will explain it as simply as possible.

The bank uses the money placed on deposit in its operations: primarily for lending to businesses and individuals. This is how it can pay interest to depositors — this is a global practice that is constantly monitored by the NBU.

Interest is compensation for the temporary use of your funds. Its amount is fixed in the agreement, does not change throughout the term, and gives you a clear understanding of the income you will receive.

Upon maturity of the deposit, the bank returns the principal amount of the deposit and the accrued interest. All settlements are made on a specified date in accordance with the agreement.

Early withdrawal is not usually provided for term deposits, as the bank plans its activities in accordance with the terms for which the funds are deposited. If you need to have access to your money at any time, you can choose programs with the option of early termination or a card with interest on the balance — their rate is lower, but they give you more freedom.

What are the types of deposits?

Depending on who places the funds, there are deposits of individuals and deposits of legal entities.

Deposits for individuals in the absolute majority are time deposits, that is, they are opened for a clearly fixed term, while businesses often choose a demand deposit - this is a deposit that can be withdrawn at the first need.

There are long-term deposits that are placed for a year or more, and short-term deposits for a period of less than a year.

In Ukraine, it is possible to place a deposit in UAH, USD and EUR, as well as in bankable metals.

Bank deposits differ in the frequency of interest payments, the possibility of replenishment, extension, partial withdrawal or early termination.

A deposit account can be opened in one's own name or by proxy from another person, as well as a deposit for a child.

Deposits in Agroprosperis Bank

Is it safe to place a deposit?

For most depositors, the main question is whether their money will disappear. Deposits are one of the safest financial instruments in Ukraine, and here's why.

State guarantees

All deposits of individuals are protected by the Deposit Guarantee Fund (DGF).

- During martial law, the state guarantees full reimbursement of the entire deposit amount and accrued interest.

- After its termination, the guaranteed amount will be at least UAH 600,000.

If something happens to the bank, the Fund will return the money within the time limits established by law — usually within 20 business days from the start of payments.

Protection against fraud

Funds in a deposit account cannot be “stolen” remotely:

- they are not available for transactions without your signature or power of attorney, even in the event of early termination;

- they cannot be debited, as is sometimes the case with card accounts;

- it is impossible to access these funds, even by stealing your online banking password.

As we can see, this is the least vulnerable type of savings for fraudsters.

Transparent and fixed terms

When opening a deposit, you sign a contract that clearly states:

- the interest rate,

- the term of the deposit,

- the payment procedure.

The bank cannot change the terms unilaterally. You know in advance how much you will receive and when.

How are deposits of individuals taxed?

Interest income on deposits is taxed in the same way as any other type of income. This is standard practice worldwide: if a person receives income, the state withholds taxes from it. In the case of deposits, the tax is 18% personal income tax and an additional 5% military tax. These are calculated only on the interest, not on the amount of the deposit itself.

It is important to understand that the rate that the bank indicates on its website or in advertisements is the actual rate that you receive. It is always indicated before taxation, and this is correct. First, the bank calculates the full amount of interest under the agreement, and then taxes are automatically withheld from this income. Therefore, you receive the amount after taxes have been deducted.

At the same time, the depositor does not need to do anything on their own. The law requires the bank to pay all taxes for you. You simply receive your net income, and the bank transfers taxes to the state in accordance with the established procedure.

For clarity: if the interest rate on the deposit is 15% per annum, the actual income after tax will be 15% × (1 – 0.23), which is equal to 11.55% per annum. That is, the bank will charge you the full 15%, but you will receive 11.55% net income, and 23% will go to the budget in the form of taxes.

What are the advantages and disadvantages of deposits?

Deposits remain one of the most convenient and secure ways to save and grow your money. Below is a brief overview of the main pros and cons.

Advantages of deposits

- Affordable minimum amount. You can start saving with a small amount, which allows you to gradually build up a financial cushion.

- Money is protected from accidental spending. Since access to funds is restricted until the end of the term, they are not spent impulsively.

- High security. Funds on deposit cannot be lost due to theft, fire, fraudsters, or other risks associated with cash or cards.

- Flexible terms. You can choose a term from one month to several years, depending on your plans.

- State guarantee. All deposits and accrued interest are returned to depositors even in the event of the bank's insolvency.

Disadvantages of deposits

- Income taxation. Interest on deposits is taxable, so the actual income will be lower than the pre-tax rate.

- Inflation risks. If inflation is higher than the rate, the real purchasing power of funds may be partially reduced.

Despite certain drawbacks, the main advantage of deposits remains unchanged: they are a tool that allows you not only to safely store your money, but also to earn income — understandable, predictable, and guaranteed by the bank.

What determines the yield of a deposit?

The yield of a deposit is determined by several key factors. First of all, the currency. Hryvnia deposits traditionally offer the highest rates, while those in US dollars and euros usually do not exceed 1–2% per annum, as foreign currency resources are less in demand by banks.

The second influential factor is the economic situation in the country. The inflation rate and the NBU's discount rate directly determine the overall level of deposit rates: when inflation rises and the discount rate increases, banks offer higher rates, and when they fall, they adjust the yield downward.

| Deposit term | UAH | USD | EUR |

| 3 months | 17,5% | 2% | 2,25% |

| 6 months | 17% | 2,5% | 2% |

| 9 months | 16,9% | 2,7% | 1,75% |

| 12 months | 17% | 3% | 2% |

Factors that affect rates on different types of deposit programs:

- Payment of interest. Rates for interest payments at the end of the term are usually higher than for a deposit with monthly interest payments.

- Possibility of replenishment. Deposits with top-up have a lower yield than without such an option.

- Term of deposit. There is no universal answer to this, it all depends on the market situation and the needs of each specific bank. But usually long-term deposits will bring you a higher return.

- Possibility of early termination. The presence of such an option reduces the rate, and upon actual termination, interest is usually paid at the minimum level.

What are the deposit rates offered by banks?

UIRD index

The UIRD index is a convenient tool for assessing the average deposit rates on the market. This indicator is calculated by Thomson Reuters based on the nominal rates of the top 20 Ukrainian banks in terms of retail deposits. The index provides a general idea of how much banks offer depositors on average in UAH, USD, and EUR.

UIRD index as of 01.12.2025

| Deposit term | UIRD value, UAH | UIRD value, USD | UIRD value, EUR |

|---|---|---|---|

| 3 months | 13,41% | 0,87% | 0,31% |

| 6 months | 13,90% | 1% | 0,39% |

| 9 months | 14,04% | 1,09% | 0,35% |

| 12 months | 13,77% | 1,21% | 0,47% |

The highest rates

It should be noted that the UIRD focuses only on the largest banks, which traditionally offer lower rates than medium-sized or small banks. Therefore, you can find deposit yields on the market that are several points higher than this index. That is why you should monitor offers on aggregator websites, which immediately display the programs of most Ukrainian banks.

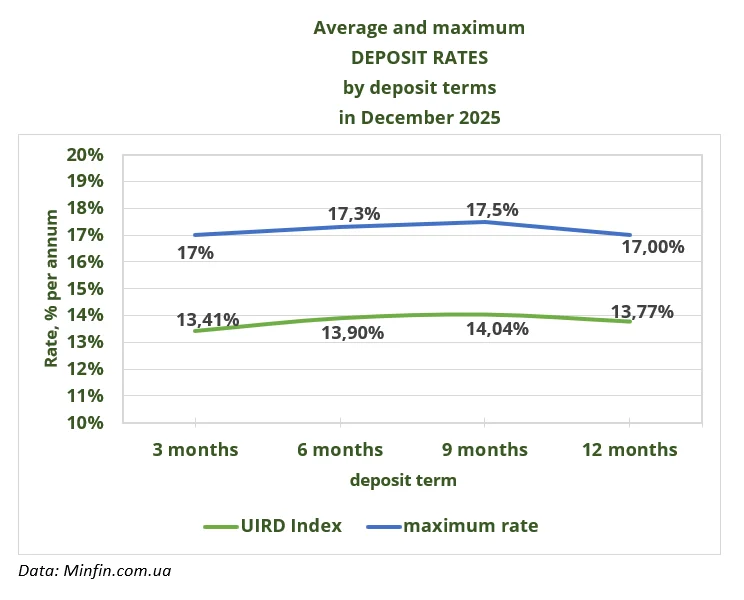

As of December 1, 2025, the maximum rate for 12-month deposits is 17.50% — 3.7% higher than the UIRD.

Depending on the term of the deposit, the difference between the average and maximum rates in December 2025 was as follows:

If you place UAH 100,000 on deposit for one year at the maximum rate of 17.5%, the deposit will yield UAH 17,500 in interest. After deducting 23% in taxes, the actual net income will be approximately UAH 13,475 — this is the amount that will end up in the client's account.

For comparison, at an average rate of 13.77% per annum, a deposit for the same amount provides UAH 13,770 in interest before tax. After paying taxes, the depositor actually receives only about UAH 10,602.

As a result, the difference between these two options is almost UAH 2,900 in net income in favor of the higher rate. This example clearly demonstrates that even a few percentage points in the nominal rate have a real financial effect, especially when assessing the income “in hand.” That is why, when choosing a deposit, it is important to analyze not only the advertising figures, but also the actual result after taxation — it is this that determines the real benefit for the client.

Deposit bonus

In many banks, it is often possible to get an additional premium to the base rate. Such a deposit bonus is mostly valid either for a large amount of deposit or for certain categories of the population: yes, you can often find a deposit for pensioners or a deposit for the military. Also, an increased deposit interest can be obtained in case of extending the deposit, placing a deposit in Internet banking or as part of a promotion.

Top 5 reasons to place a deposit

Bank deposits have many advantages over keeping money in cash or current accounts, as well as other passive income opportunities.

1. Protection against inflation

Cash loses its purchasing power over time. Deposit interest allows you to preserve and grow your capital, offsetting the rate of inflation. Read more about this in our article How to protect your money from inflation with a deposit?

2. Your financial cushion

Regular savings help you build up a reserve for unexpected expenses or make large purchases. Bank deposit accounts are an easy way to create your own reserve fund. Long-term deposits are particularly well suited for this, as they give you a sense of confidence in the future.

3. Convenient and simple registration

Opening a deposit is quick and easy, even without any special knowledge. At a bank or through online banking, the process takes from a few minutes to an hour, and interest begins to accrue immediately. The procedure for opening a deposit takes less than an hour, and in online banking — only a few minutes — and you already start earning deposit interest.

4. Security and protection of funds

Deposit funds are securely stored in the bank and protected by the state through the Deposit Guarantee Fund for Individuals. This is much safer than keeping large sums of money “under the mattress.”

5. Investment accessible to everyone

You don't need to be wealthy to start investing. You can make a deposit in a bank even with a small amount of money — and this is the first step towards financial stability. At the same time, no associated fees are charged on deposits, unlike government bonds or shares, where small investments are unprofitable because of this.

Glossary

A bank deposit is cash or non-cash funds in national or foreign currency that customers place in their personal accounts at a bank on a contractual basis for a specified term or without specifying such a term and which are payable to the depositor in accordance with Ukrainian law and the terms of the deposit agreement. Bank deposits are opened in accordance with the terms of the bank deposit agreement between the bank and the depositor.

A deposit account is an account that a bank opens for a customer specifically for the purpose of placing a deposit. It contains key terms and conditions: the currency in which the funds are held, the term for which they are placed, the interest rate set, how interest is accrued, and whether it is permitted to replenish the deposit or withdraw part of the funds before the end of the term.

A depositor is an individual (including an individual entrepreneur) who has entered into or on whose behalf a bank account or bank deposit agreement has been entered into, except for an individual (including an individual entrepreneur) who is the owner of only a bank savings certificate.

A bank deposit agreement is a document that records the agreement between the bank and the depositor on the placement of funds. The agreement specifies the amount, term, currency, interest payment procedure, rules for using the account, and other conditions under which the deposit is accepted, stored, and returned to the customer.

To feel confident in choosing a bank, deposits, rates and other deposit conditions, read our previous materials: