Article content

- What is Inflation?

- How inflation affects your current expenses

- How inflation affects savings

- How to minimize the impact of inflation

- Deposits: an effective tool for protecting savings from inflation

- How best to save money with a deposit and which option to choose

The issue of protecting and preserving savings is relevant at all times but becomes especially acute during periods of instability. Amid high inflationand declining real incomes, many Ukrainians are thinking about how to protect their hard-earned money from depreciation in order to look to the future with more confidence. This article will explore how much we lose to inflation, strategies to minimize its negative impact, whether deposits are effective in countering it, and whether deposit rates can offset these losses and generate additional income.

What is Inflation?

Inflation is the decline in the purchasing power of money, meaning that with the same amount of money, you can buy fewer goods and services each year. Although often perceived as a negative process, moderate inflation can indicate economic growth. A complete lack of price growth may point to stagnation, which is also undesirable for the economy.

To measure inflation, the Consumer Price Index (CPI) - an indicator that reflects the change in the average price level for a set of the most typical goods and services that are included in the so-called consumer basket.

Inflation is classified by rate:

- low inflation (0–6% annually): Indicates stability, with prices rising gradually and in a controlled manner;

- moderate inflation (6–10% annually): Features faster price increases but remains within acceptable limits;

- creeping inflation (up to 20% annually): Signals potential economic challenges that require attention;

- galloping inflation (20–200% annually): Represents a rapid rise in prices, which can significantly affect economic stability and public welfare;

- hyperinflation (over 200% annually): Leads to a critical depreciation of money and severe economic crises.

The State Statistics Service of Ukraine publishes the Consumer price index (inflation index) monthly, while the National Bank of Ukraine provides a quarterly inflation report with macroeconomic forecasts. This information is also available in reports from international organizations such as the World Bank or the IMF and in analytical materials from financial experts.

How inflation affects your current expenses

Prices rise gradually, and the impact of inflation becomes noticeable over time.

Consider this: 1,000 UAH today and 1,000 UAH 10 or 20 years ago are vastly different sums in terms of what they can buy. Today, this amount may cover a single grocery trip, while 10 years ago, it was a substantial sum.

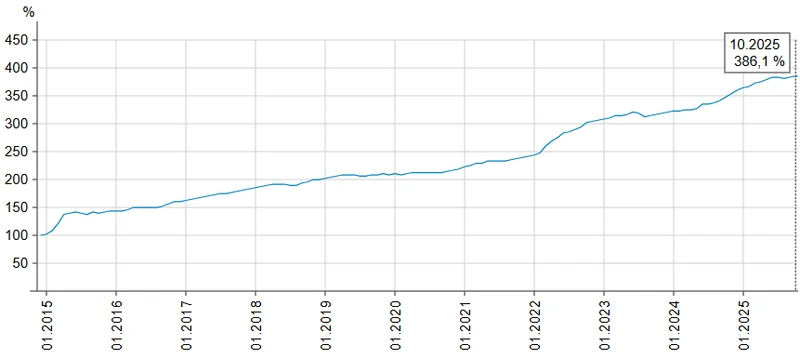

1,000 UAH in 2015 in terms of purchasing power are equal to approximately 259 hryvnias in 2025 prices. This is the result of accumulated inflation over 10 years: prices have increased approximately 4 times.

Inflation in Ukraine in 2015-2025 cumulatively

Data: minfin.com.ua

Cumulative inflation refers to the overall change in the price level over many years, where annual inflation rates are not added together arithmetically, but multiplied by each other.

How inflation affects savings

Protecting savings during times of economic challenges requires a well-thought-out strategy. Inflation gradually reduces the purchasing power of your funds, and the extent of this impact depends on how they are stored. Let’s examine how various saving options respond to inflationary pressures.

Savings in hryvnia

Money kept in hryvnia, whether at home or in a non-interest-bearing bank account, is particularly vulnerable to inflation. For example, with an annual inflation rate of 10%, a sum of 10,000 UAH will only purchase goods worth 9,000 UAH at current prices after one year. This means that keeping savings "under the mattress" essentially erodes part of their real value.

Savings in foreign currency

The US dollar and euro are more resistant to inflation because they are backed by stable economies and are among the most popular reserve currencies globally. Holding money in these currencies in Ukraine can help protect savings from UAH devaluation, though it does not guarantee protection from the loss of purchasing power. The dollar and the euro also depreciate over time due to inflation, but the rate of this depreciation is much lower than that of the hryvnia, so simply buying and holding currency is not enough to fully protect your savings.

How to minimize the impact of inflation

Let’s explore how to save money effectively and what financial strategies can be used to reduce the adverse effects of inflation on savings.

Diversify savings across currencies

The first tip is not to keep all your savings in one currency. An optimal strategy may involve distributing funds among UAH, USD, and EUR. This helps mitigate risks associated with inflation or the devaluation of a single currency.

Invest your money to make it work

Never keep money in cash or a current account, especially in the national currency. Instead, invest in financial instruments or assets that preserve or increase the value of your savings. Popular options include:

- Real Estate. Investments in real estate or land can protect capital from depreciation, particularly over the long term. However, consider maintenance costs and risks related to market fluctuations and security factors.

- Stocks and Bonds. Stocks allow you to earn profits from dividends and price growth, while bonds provide stable fixed income. Over the long term, both instruments typically outpace inflation, although stocks are generally more volatile.

- Deposit Accounts. For most Ukrainians, the simplest and most common way to save money is to place it in a bank deposit.

For more information about different ways to invest free funds to generate passive income, read our article "How to create passive income?".

Deposits: an effective tool for protecting savings from inflation

The advantages of deposits compared to other investment methods are clear:

- opening a deposit requires no additional knowledge, significant effort, or hiring brokers or consultants;

- the income amount is clearly defined, and the receipt of interest and return of the principal are guaranteed;

- the investment amount is minimal, and the term can range from 1 to 24 months;

- deposit rates in hryvnia exceed the inflation rate, allowing not only protection of funds from depreciation but also their growth.

Do deposit rates cover inflation?

The interest rate offered by banks depends on the NBU key policy rate, which is a crucial tool for combating inflation. When inflation rises, the National Bank may raise the discount rate to make hryvnia instruments more attractive and contain price increases, which, in turn, encourages higher deposit rates. The National Bank implements a consistent monetary policy aimed at enhancing the attractiveness of hryvnia deposits for the population. As a result, deposit rates in UAH typically exceed the inflation rate.

Was it possible to protect savings with a deposit in 2025?

Let’s examine an example to see whether it was possible to safeguard money from inflation by using a deposit in 2025.

Let's say you placed UAH 100,000 on deposit at Agroprosperis Bank on November 1, 2024. Then the rate on the deposit for 12 months was 15% p.a., which after tax on the deposit is 11.55% p.a. of net income on hand.

Inflation in Ukraine for the period November 2024 — October 2025 was 10,9%. Subtracts We subtract inflation from 11.55% p.a. net income 10.9% and get 0.65% of net real income for the year. That is, you would be able not only to fully compensate for inflation, but also to earn extra money.

And if you had deposited UAH 100,000 at home on November 1, 2024, you would have lost UAH 10,900 due to inflation. So the answer to the question "Is it worth putting money on deposit?" obvious.

How best to save money with a deposit and which option to choose

When considering whether to save money in a deposit in national or foreign currency, opt for a hryvnia deposit with a high-interest rate. Hryvnia deposits typically offer significantly higher returns than foreign currency deposits and often allow not only compensation for inflation but also the opportunity to earn additional income. The key is to choose a reliable bank with favorable terms.

UAH savings best to placed in a deposit, while foreign currency can be kept either in a deposit or in a current account for quick access to funds if needed.

A convenient solution is to open a long-term deposit with the option to add funds. Such a deposit allows you to benefit significantly if market rates decline. Since the interest rate for the deposit is fixed for the entire term and applies to both the initial deposit amount and any additional contributions, you will continue to earn the same high rate on new funds without needing to open a new deposit.

Inflation affects everyone, but choosing the right financial instruments, such as deposits with Agroprosperis Bank, can help not only preserve the purchasing power of your savings, but also generate additional income.

For more useful information, read our other articles: