Article content

- What does interest capitalization mean?

- How to calculate income on a deposit with capitalization

- What is the difference between a deposit without capitalization and a deposit with capitalization

- For whom capitalization deposits are suitable

When choosing bank deposits, every depositor is primarily interested in the size of the interest rate, while paying little attention to the order of interest payment. However, sometimes a lower rate can result in a higher final return, such as in the case of a capitalization deposit. In today's article, we will consider what interest capitalization is, how to calculate income and when it is more appropriate to choose such deposits.

What does interest capitalization mean?

Capitalization of interest is a form of payment of income on a deposit, in which accrued interest is added to the principal amount of the deposit, that is, compound interest is applied.

The vast majority of deposit programs provide for monthly capitalization, when every month the amount of the deposit increases by the amount of accrued interest, and the next accrual of interest occurs already on the increased amount.

For example, if a deposit was opened on March 1 for the amount of 100,000 UAH, interest is accrued for the period from March 2 to March 31. Interest is capitalized on April 1, and subsequent interest is calculated based on the increased amount - 100,000 UAH plus the income accrued for the first month.

Thus, as a result, accrued interest generates new interest, which contributes to the accelerated growth of savings in the long term. This approach provides a higher effective interest rate compared to the base rate.

How to calculate income on a deposit with capitalization

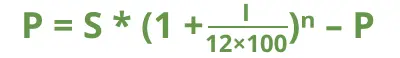

If you chose a deposit program that provides capitalization of interest, the formula for calculating the amount of income is more complicated than in the case of simple interest, and looks like this:

where:

P — accrued income

S — the initial deposit amount

I — interest rate, % p.a.

n — the number of months of capitalization

Let's consider an example. Suppose you invest 100,000 UAH at a rate of 15% p.a. for 24 months. Let's calculate the amount of interest paid according to the given formula:

S = 100 000 * (1+ 15/12*100)24 – 100 000 = 34 735,11.

So, by placing 100,000 UAH on such a deposit for 24 months, as a result, you will receive 34,735.11 UAH of income. This figure may have slight fluctuations, since the amount of accrued income depends on the number of days in the month. Read more about this in our article "How to calculate the profit from the deposit".

What is the difference between a deposit without capitalization and a deposit with capitalization

A deposit without capitalization provides for the calculation of a fixed interest rate on the amount of the deposit and top-ups with their payment to the depositor monthly or at the end of the term in accordance with the terms of the deposit.

If the bank deposit agreement provides for capitalization of interest, the bank calculates interest every month, but does not pay it to the depositor, but adds it to the amount of the deposit. This new increased amount becomes the basis for calculating the following interest, that is, each month the amount of accrued income will become more and more.

Capitalization of the deposit occurs in this way every month until the end of the term of the deposit, and it is obvious that the longer this term is, the higher the income can be earned and the more profitable it is to choose such a deposit.

With capitalization, income is calculated by the method of compound interest and grows exponentially, while with a regular deposit, simple interest is accrued and income grows linearly.

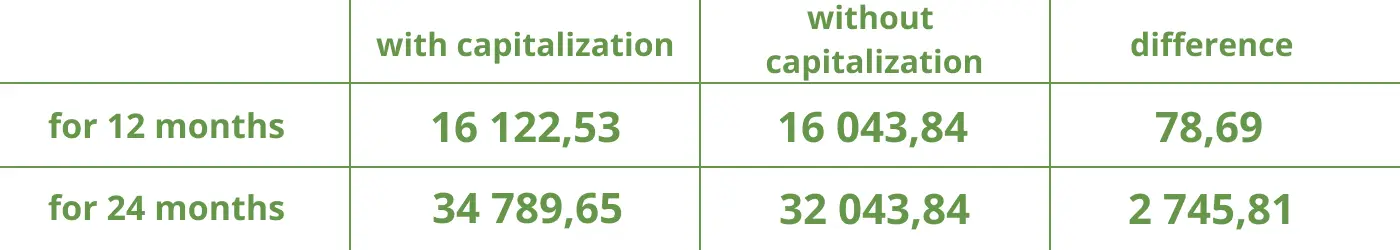

Let's look at real numbers and compare which type of deposit is more profitable to choose when placing 100,000 UAH for a period of 12 and 24 months. Traditionally, the capitalization rate will be 0.5-1% lower than with a classic payment, so in our calculations we will proceed from rates of 15% p.a. and 16% p.a., respectively.

What income will you get as a result:

It immediately catches your eye that with a term of 12 months, both options are almost equivalent, however, when the term is only doubled, the compound interest becomes much more profitable, even taking into account the not so high rate. The conclusion is obvious - the longer the deposit period and the more replenishments, the more significant your benefit will be.

To calculate income from a deposit, it is convenient to use the deposit calculator, which is necessarily available on the website of every bank and on various websites about banking services. The calculations presented in this article were made on the Finance.ua portal.

For whom capitalization deposits are suitable

When choosing between a deposit with capitalization and other types of deposits, it is worth considering not only profitability, but also other conditions and features of each option. This will allow you to make the most thoughtful choice. Usually, banks set a lower rate on deposits with capitalization and it appears that it will ultimately bring less money. But taking into account the peculiarity of the calculation of interest, not everything is so clear-cut. Therefore, look not at the rate, but at the final income that you will receive from the deposit.

Interest capitalization is a profitable solution in the long term: the longer the term of the deposit, the more income you will receive. This is clearly demonstrated by our calculations. Therefore, this option is attractive primarily for those who intend to accumulate funds for the purchase of real estate, until the child comes of age, or for their pension.

In the case of capitalization, you will receive your income only at the end of the term of the deposit agreement, so if receiving a monthly income from your savings is key for you, you should consider other options.

We can conclude that the capitalization of deposit interest is suitable for those depositors who:

- have no need for monthly interest payments;

- strive to accumulate the maximum possible amount;

- are ready not to use the funds for a long time.

In fact, such a bank deposit with interest capitalization is one of the best financial instruments for accumulating funds, because, in addition to a fairly high yield, it has a very low risk, is guaranteed by the state and requires a minimum of effort for registration. Read about other tools for savings and obtaining additional income in our article "How to create passive income".